बिना नेट बैंकिंग की सुविधा के भी अब खोल सकते हैं अटल पेंशन योजना खाता – जानिए पूरी डिटेल

अटल पेंशन योजना (APY) खाता खोलने के लिए अनेक बैंक नेट बैंकिंग या मोबाइल एप्प के द्वारा सुविधा प्रदान करते हैैं। लेकिन अनेकों ऐसे भी खाताधारी हैं जिनके पास नेट बैंकिंग अथवा मोबाईल एप्प की सुविधा नहीं है। जिसके कारण वे अटल पेंशन योजना (APY) खाता खोलने में असमर्थ होतेे हैं। उनकी असुविधा को ध्यान में रखकर सरकार एक वैकल्पिक व्यवस्था उपलब्ध कराने के िलिए सभी APY-POPs को अनुमति प्रदान की गयी हैैै।

इस वैकल्पिक व्यवस्था के तहत बैंक खाताधारक अपने बैंक की वेबसाईट पर जाकर Customer Id/Saving Bank Account Number/PAN (कोई दो) या आधार नम्बर की सहायता से APY खाते के लिए Enroll कर सकता है।

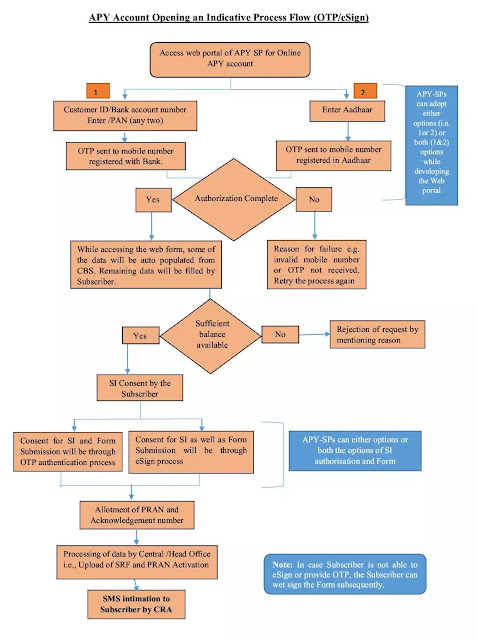

PFRDA द्वारा जारी दिशा-निर्देश में इसका सांकेतिक फ्लो चार्ट दर्शाया गया है-

To

All APY POPs

Subject: Online on-boarding through Bank’s own web portal

At present some banks are providing online APY account opening through Net-banking or mobile app. However, it is learnt that large number of bank’s customers who are eligible and can be enrolled under APY are not using the Net-banking or mobile app facility. In such cases, these bank customers are not able to open an APY account through online/digital mode.

2. Accordingly, as a step towards easing the on-boarding process of APY subscribers, APY-POPs are being permitted to introduce an alternate channel for online on-boarding of their existing Saving account customers, under Atal Pension Yojana, without using Net-banking or mobile app. An indicative process-flow for ‘Online Paperless On-boarding of Subscribers using the Web Portal’ for banks is being attached herewith.

3. In this arrangement bank customer will visit the Bank’s portal providing APY on boarding facility and initiate the registration process, by providing the Customer ID/ Savings Bank Account Number /PAN (any two) or using Aadhaar number. These two modes shall help banks to identify their customer. Banks shall have the option either to develop both modes or any one mode of initiation of onboarding process. OTP based authentication is envisaged in both modes to complete the first step.

4. On completing the first step an access to the web form shall be provide. While accessing the web form, some of the data will be auto populated from CBS. Remaining data like Pension amount, Frequency of auto-debit and nomination etc. will be filled by customer of the Bank. Consent for SI and APY Enrolment Form Submission to the Bank may be done digitally through OTP authentication of using e-sign, In case Subscriber is not able to e-Sign or provide OTP, the Subscriber can wet sign the Form subsequently and submit the same to his bank-branch.

5. While implementing the aforementioned online on-boarding process banks may follow the attached indicative processes but shall satisfy minimum following conditions:

-

Ensuring Two-way authentication in case of Subscriber not e-Signing the request.

-

Ensuring KYC as per linked Savings Bank: account and adherence to PMLA Act

-

Maintaining the audit trail for all financial and non-financial transactions and their quick retrieval at the time of audit and inspection

-

Maintaining the records as per IT Act and applicable rules and ensuring the cyber security of the system.

-

Informing subscribers about rejection of their requests, with an advise to visit the respective branch for completion of remaining formalities.

-

Time to time reconciliation of the enrolments done through this mode.

-

Compliance of the RBI guidelines, if any; on the subject-matter.

Ashish Kum

(Chief General Manager)

Source : PFRDA